This following is an interview with Nikhil from LeapoN.

Q: Nikhil, tell us about your journey with LeapoN.

A: I started LeapoN with a unique vision: to simplify the lives of small and medium-sized entrepreneurs by enhancing their digital presence and providing scheduling, client management, and communication tools in one. My inspiration came from my own experience, witnessing the struggles of professionals with client attraction and operational efficiency. This led to the creation of LeapoN, a technology platform designed to enhance digital presence and streamline operations for financial advisors.

Q: How did you find the transition from India to Canada on a personal level? What made you stay?

A: The transition wasn't easy due to the cultural differences and the challenge of starting from scratch in a new city. It took time to make friends and feel at home. However, Canada's respect for diversity and opportunities for immigrants motivated me to stay.

Q: What surprised you the most about doing business in Canada vs. India?

A: Gaining credibility in a new country is challenging for immigrants. I met an entrepreneur in Ontario who struggled to establish trust in a new country without social connections. It took them 4-5 years to see their business thrive.

Q: What inspired you to focus on the financial industry, and how does it shape your vision for Canadian business?

A: My journey began when I sought guidance from a financial advisor for my personal investments. I realized the industry lacked efficient tools, such as scheduling and communication. My background outside the financial industry inspired me to empower advisors with digital tools, shaping LeapoN's mission to redefine how they operate in the digital age.

Q: Tell us about LeapoN's personalized web presence and communication tool for financial advisors.

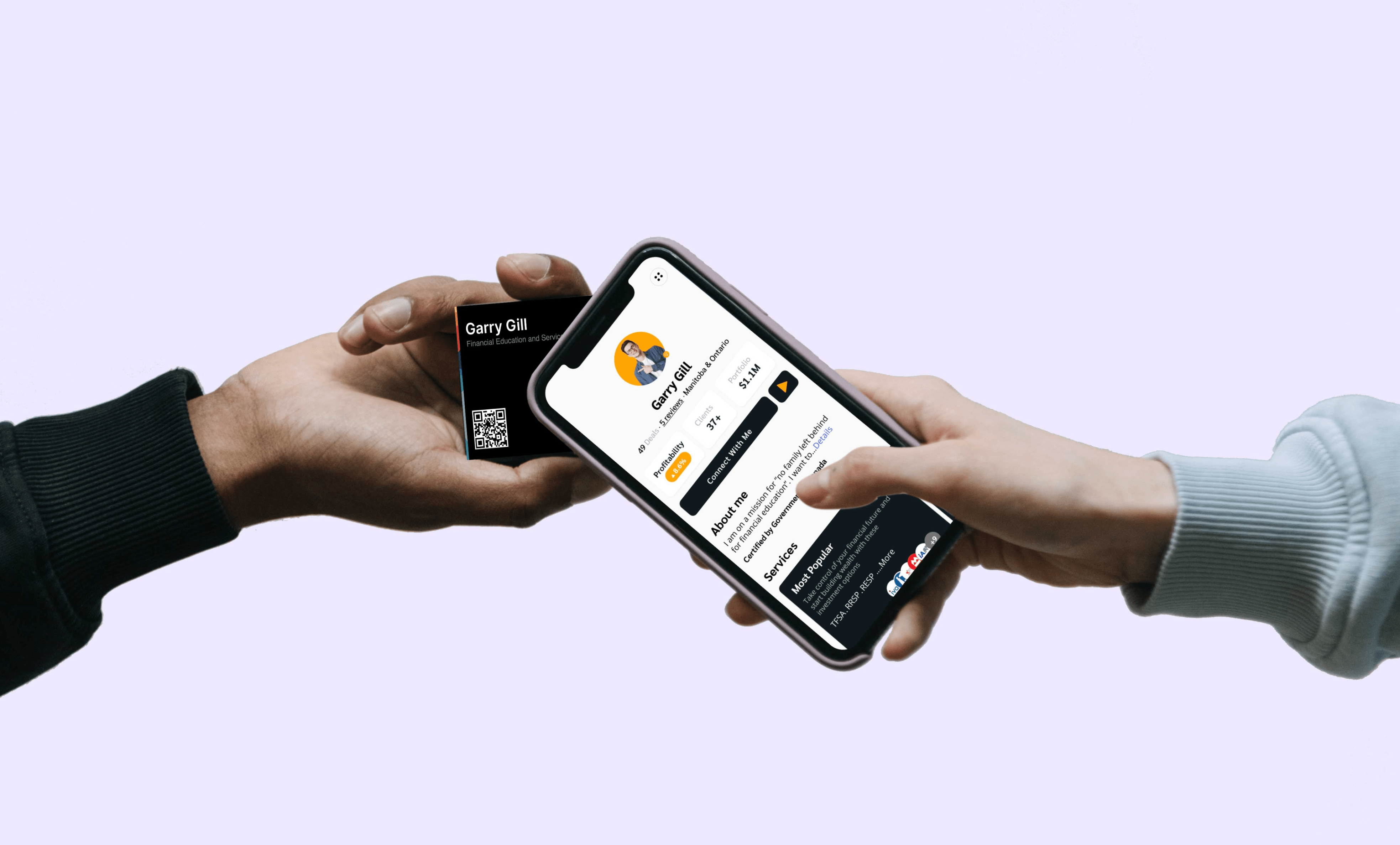

A: LeapoN allows financial advisors to create personalized websites and digital visiting cards in just three minutes. This enhances their online presence, increases credibility, and simplifies operations. The platform automatically adds contacts to the advisor's prospect list, streamlining business operations. LeapoN also provides a robust communication tool for personalized engagement with prospects and clients.

Q: Share a success story of LeapoN making an impact on a financial advisor in the Canadian market.

A: An advisor from Manitoba faced challenges in growing their business efficiently. With LeapoN's tools, they established a strong digital presence and improved business operations. Digital methods enhanced client growth, saving 50% of their time on follow-ups and rescheduling. A client testified, "LeapoN took my business to a different dimension, making scheduling and professionalism easy."

Q: What innovations can we expect from LeapoN in the future, and how will the Canadian business environment influence them?

A: We aim to harness emerging technologies, including AI, to offer more efficient solutions for financial advisors while staying compliant with Canadian regulations. These innovations will empower advisors to thrive in the digital age, tailored to meet their specific needs in the Canadian business landscape.

Q: How can financial advisors get started with LeapoN, and are there any unique considerations for the Canadian market?

A: Getting started is easy with a quick sign-up and a one-month free trial. In three minutes, advisors can set up their personalized websites and access our comprehensive toolset. We offer dedicated support and a thriving community, providing financial advisors in Canada the confidence to grow their businesses.