Nova Scotia Business Registration (6 Step Detailed Guide)

Registering a business in Nova Scotia is a crucial step towards launching your entrepreneurial venture. Whether you're a sole proprietorship or a corporation, the process involves several steps and considerations to ensure your business complies with local regulations and operates smoothly. In this guide, we will walk you through the six essential steps to register a business in Nova Scotia, from understanding the necessity of registration to fulfilling ongoing compliance obligations.

Step 1 - Do You Need to Register Your Business?

Before going through the effort of registering your business, double check that you actually need to register. The Government of Nova Scotia is clear about the requirement to register a business. If your business operates in Nova Scotia, and doesn't meet one of the narrow conditions highlighted below, then you must register.

By law, all businesses or non-profits operating in Nova Scotia must register with Registry of Joint Stock Companies except:

- corporations, sole proprietorships, partnerships and business names (operating names) formed in New Brunswick

- sole proprietors or partners using only their personal names (for example, you don't need to register 'John Smith', but you do need to register 'John Smith and Associates')

- sole proprietorships and partnerships whose sole purpose is farming or fishing

Reference: Registry of Joint Stock Companies

Step 2 - Choose the Right Nova Scotia Business Structure

The two most common business structures in Nova Scotia are sole proprietorship and corporation. Partnerships will not be the focus of this guide.

Different Business Structures in Nova Scotia

- Corporation (Nova Scotia)

- Corporation (Federal)

- Sole Proprietorship

One-time government fee: $200

One-time name reservation fee: $61.05

Annual government fee: $118.35

Extra-Provincial Registration.Federal corporations with a headquarters in Nova Scotia must complete the extra-provincial registration process.

One-time government fee: $200

One-time name reservation fee: $13.80

Annual government fee: $12

One-time name reservation fee: $61.05

Government Fee: $68.55 each year

Pros and Cons of Different Business Structures

| Business Type | Setup Fees | Pros | Cons |

|---|---|---|---|

| Corporation | $$$ | Legal shield, easier to invest in, potential tax benefits | More complex, more expensive to set up and maintain |

| Sole Proprietorship | $ | Simple structure & reporting | No legal separation between the individual and the business |

| Partnership | $ | Can share costs between individuals | No legal shield, decisions require consensus between partners |

Illustrative Costs Associated With Each Business Structure

| Corporation | Sole Proprietorship | |

|---|---|---|

| One-time Government Name Search or Reservation Fee | Federal - $13.80 Nova Scotia - $61.05 | $61.05 |

| One-time Government Fee | Federal - $200 Nova Scotia - $200 | $68.55 |

| Annual Government Fee | Federal - $12 Nova Scotia - $118.35 | $68.55 |

| One-time Extra-Provincial Registration Fee | Federal - $61.05 Nova Scotia - N/A | N/A |

| Annual Extra-Provincial Registration Fee | Federal - $274.10 Nova Scotia - N/A | N/A |

| Legal | Lawyer ($1000+ and $500+/year), Ribbon ($300+/year) | $0+ |

| Accounting | $1000+ for tax return preparation | $300+ for tax return preparation |

| Accounting Software | $0 to $700/year | $0 to $700/year |

| Payroll Software | $20/month + $3/employee | $20/month + $3/employee |

Disclaimer. These are ballpark numbers to give a sense, situation and requirements will dictate

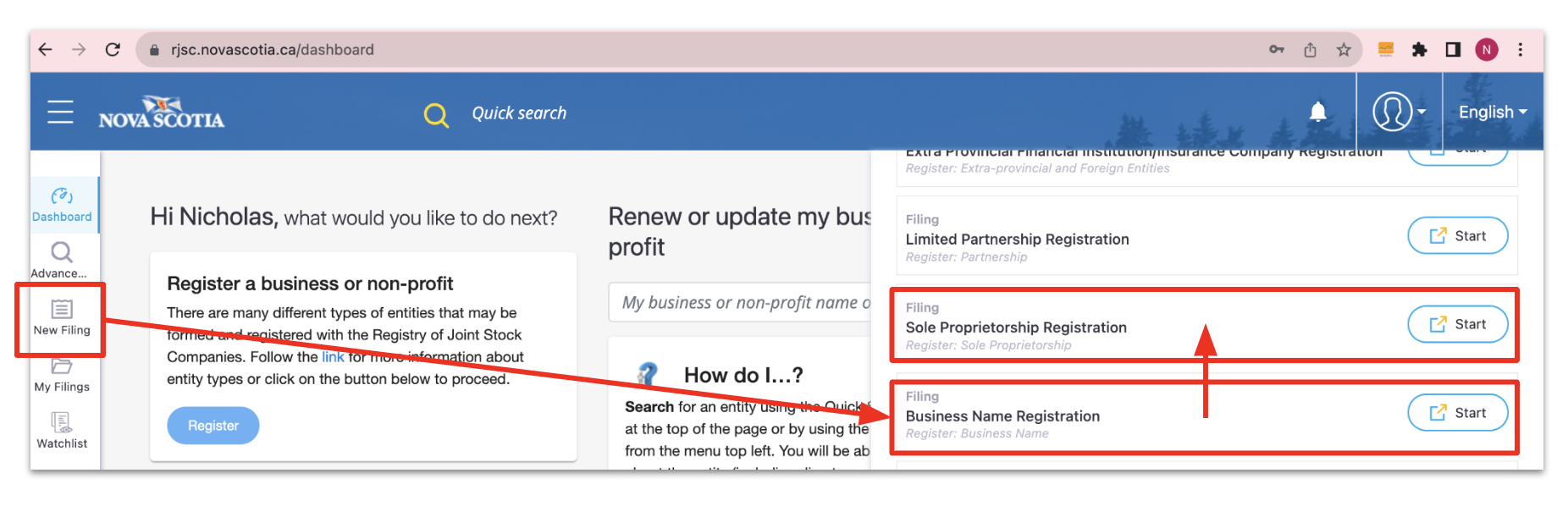

Step 3a - Register a Sole Proprietorship in Nova Scotia

Registering a Sole Proprietorship in Nova Scotia can be completed online and is typically processed in 1-2 weeks.

Steps to register a Sole Proprietorship:

Search for Name Conflicts. Check for name conflicts for your proposed name using the Registry of Joint Stock Companies and the Canadian Trademarks Database. Read the detailed guide on Nova Scotia Business Names.

Create Registry of Joint Stock Companies Account. Register an account to get access to services required for the next two steps.

Submit a "Name Reservation Request". Through Registry of Joint Stock Companies submit a Business Name Registration, part of this process will be a $61.05 fee.

Register a Sole Proprietorship Through Registry of Joint Stock Companies submit a Sole Proprietorship Registration, part of this process will be a $68.55 fee.

Step 3b - Incorporate in Nova Scotia

Businesses can be incorporated in Nova Scotia as either a Federal Corporation or a Nova Scotia Corporation. There are some relatively minor differences but importantly both can sell across Canada and across the globe. This guide will cover federal corporations with Nova Scotia extra-provincial registration.

Registering a Federal Corporation with Nova Scotia Extra-Provincial Registration

Extra-provincial registration in Canada refers to the process of a business entity obtaining permission to operate in a province or territory other than the one in which it was initially incorporated.

Steps to Incorporate a Federal Corporation with Nova Scotia Extra-Provincial Registration:

- NUANS Name Search. Conduct a NUANS name search through the Corporations Canada portal. Cost is $13.80 and is completed almost immediately.

- Incorporate with Corporations Canada. Through the online portal, the same one you used for the NUANS Name Search, incorporate your business and pay a $200 fee. Corporations Canada provides recommended text you can use for items such as share classes, restrictions on share transfers, etc. Through the process you are required to sign the

Articles of IncorporationandInitial Registered Office Address and First Board of Directorsboth of which are generated for you. You must keep a signed copy of both these documents. - Nova Scotia Extra-Provincial Registration. Reserve a Nova Scotia Business Name using Registry of Joint Stock Companies. Complete the Extra Provincial Corporation Registration Form, submit all required documents and pay the required fee. The fee for extra-provincial registration is $22.84/month. When initially registering the fee will be prorated based on when your business was incorporated.

- Set Up Minute Book and Resolutions. Each corporation must maintain a minute book, which holds registers, ledgers, bylaws, resolutions, articles of incorporation, etc. Every corporation must also have the board of directors and shareholders issue certain resolutions relating to topics such as bylaws, appointing officers and directors, waiving of an auditor, etc. This step can get pretty confusing and it's recommended you hire legal/accounting advisors or use a service like Ribbon to do this for you.

Federal Corporations, compared to Nova Scotia Corporations, have higher legal name protection and can move their HQ between provinces. Nova Scotia Corporations have the benefit that they don't need to complete the extra-provincial registration process in Nova Scotia.

You incorporated your company under federal legislation or a foreign jurisdiction on 01 January 2018. You register your company in Nova Scotia in November 2018. You pay an initial registration fee of $45.68 (for November and December).

Calculation:

(fee: $22.84) x (# months: 2) = $45.68

Step 4 - Set Up Tax Accounts

Canada Revenue Agency Business Number. A business requires a Canada Revenue Agency Business Number if it is a corporation or if it needs a Canada Revenue Agency Account (GST/HST, Payroll Deductions, Import/Export). The Business Number is automatically assigned for corporations but sole-proprietorships need to apply for them.

Every Federal Corporation is automatically signed up for the Canada Revenue Agency Business Number. When filing a T2 Tax Return with the Canada Revenue Agency, the Nova Scotia provincial corporate tax is taken by the Canada Revenue Agency so a separate provincial income tax return is not required.

Goods and Service Tax/Harmonized Sales Tax (GST/HST) Account. Sales tax in Nova Scotia are integrated with the Canada Revenue agency and are charged as 15% HST on sales. If a business has sales of greater than $30,000 within the past 12 months it must register for a GST/HST account with the Canada Revenue Agency. Businesses that don't meet this mandatory threshold may still optionally register for the GST/HST account.

Payroll Account. If you have employees, and you hire them as employees not as contractors, you must register for a Payroll Account with the Canada Revenue Agency. Certain mandatory deductions such as Canada Pension Plan, Employment Insurance and Income Tax Deductions are remitted through the Payroll Account.

Step 5 - Obtain Licences and Permits

In general Nova Scotia is very business friendly, if you are ever uncertain of requirements you can call up a local government entity (city, township, etc.) and speak with a representative to clarify requirements for you to obtain the correct permit or licence.

BizPal is a great resource that makes it easy to search for the permits and licences you may need to start or grow your business

Step 6 - Stay Compliant - Annual and Ongoing Obligations of Nova Scotia Businesses

Sole Proprietorship Obligations

A sole proprietor must file a T1 Tax Return (Individual Tax Return) if the business:

- has to pay tax for the year;

- disposed of a capital property or had a taxable capital gain in the year;

- has to make Canada Pension Plan/Quebec Pension Plan (CPP/QPP) payments on self-employed earnings or pensionable earnings for the year;

- wants to access employment insurance (EI) special benefits for self-employed persons; or

- received a demand from the Canada Revenue Agency to file a return.

Reference - Canada Revenue Agency

Business Registry. Sole proprietorships must renew their registration with the Nova Scotia Joint Registry of Stock Companies annually.

The remainder of the sole proprietorship obligations depends on what tax accounts, permits and licences they have signed up for.

Corporation Obligations

Corporate obligations are more demanding than the sole proprietors

Key annual and ongoing obligations

- File an annual return with the relevant business registry

- File T2 return with the Canada Revenue Agency

- File relevant returns for Canada Revenue Agency Program Accounts (GST/HST, Payroll, Import/Export, etc.)

- File relevant provincial taxes (may be required if you sell/operate in other provinces)

- Maintain a minute book

- Complete mandatory director and shareholder duties

- File relevant returns or file renewals for permits and licenses as applicable

Ribbon Makes Business Easy

To keep a corporation compliant is challenging. Ribbon gives entrepreneurs the tools to help them stay compliant. From setting up minute books, maintaining registers to annual filings, Ribbon let's Entrepreneurs focus on their business. Learn more about Ribbon or email support@getribbon.ai.

Conclusion

In summary, initiating the business registration process in Nova Scotia is a crucial step that establishes the groundwork for your entrepreneurial venture in this province. By adhering to the six steps delineated in this guide, you can successfully navigate the complexities of business registration, select the appropriate structure, and fulfill your tax and licensing responsibilities. Whether you decide on a sole proprietorship or a corporation, maintaining adherence to local regulations is imperative for ensuring the sustained prosperity of your enterprise. Keep in mind that there are various resources and tools at your disposal to assist you throughout this procedure.