What are Articles of Incorporation?

When you're starting a new business in Canada, there are several crucial steps to follow to ensure your venture operates legally and smoothly. One of these essential steps is filing Articles of Incorporation. But what exactly are Articles of Incorporation, and why do you need them? This article is specifically tailored for federal corporations in Canada and may only be partially applicable to provincial corporations.

What Are Articles of Incorporation?

Articles of Incorporation are legal documents submitted to a business registry. They outline the fundamental details of your business's structure and operation, officially establishing it as a corporation. These documents serve as the foundation of your business's legal identity in Canada.

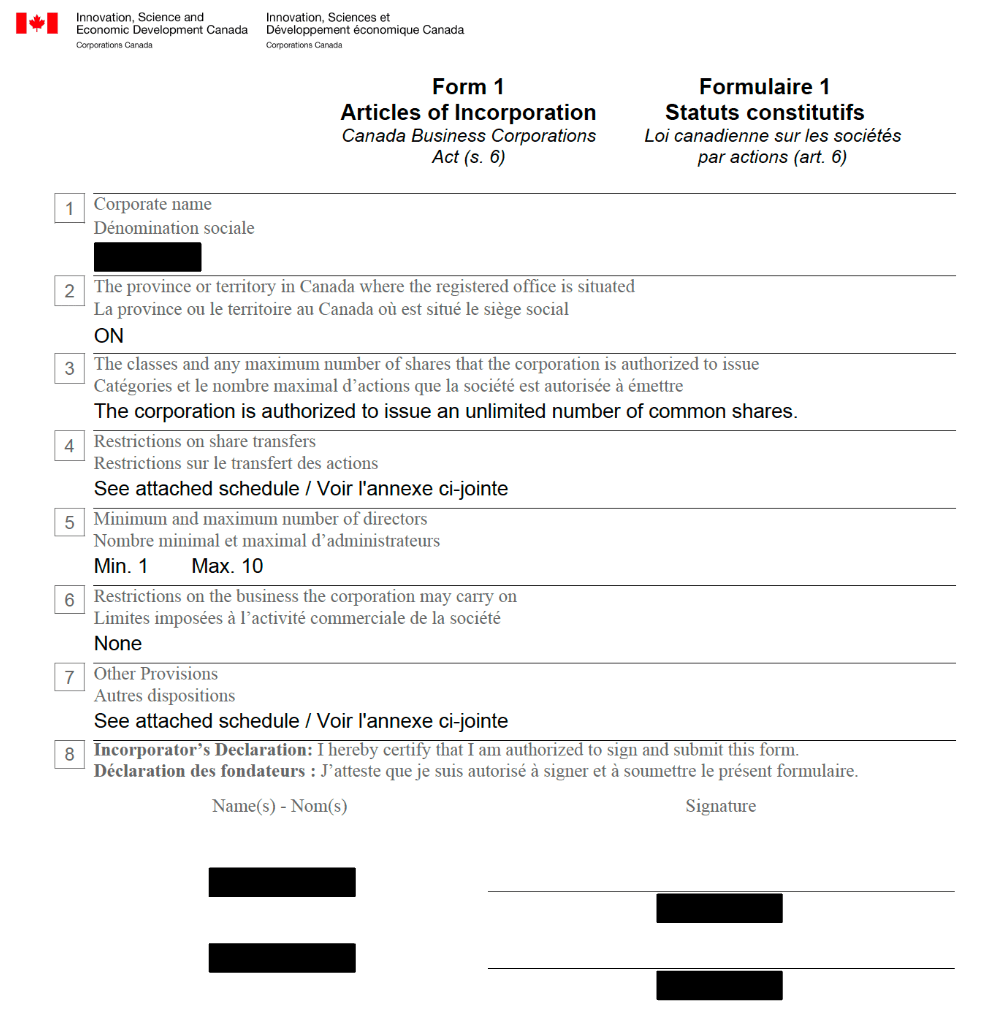

Key Components of Articles of Incorporation:

Corporate Name: You'll need to specify the name under which your corporation will operate. Ensure the name you choose is unique and compliant with government regulations.

Province for Headquarters: Indicate the province in which your corporation's headquarters will be located. This is important for tax and legal purposes.

Authorized Shares: Specify the classes of shares your corporation is authorized to issue and set the maximum number of shares allowed. This information is vital for the ownership structure of your corporation.

Share Transfer Restrictions: Your Articles of Incorporation can include restrictions on transferring shares. Typically, this would require approval from the directors or shareholders through a resolution.

Directors: Determine the minimum and maximum number of directors who will manage your corporation's affairs.

Business Restrictions: If there are specific limitations on the type of business your corporation can conduct, these should be detailed in your Articles of Incorporation.

Other Provisions: Any additional clauses or provisions that are specific to your corporation's needs can be included in this section.

The Process of Filing Articles of Incorporation:

Submission: After drafting your Articles of Incorporation, you'll need to submit them to the appropriate government agency, depending on the jurisdiction in which you plan to incorporate.

Incorporator's Signature: The document must be signed by the incorporator or incorporators, indicating their intention to create the corporation.

Review and Approval: Once submitted, the government agency reviews your Articles of Incorporation for compliance with legal requirements and, if everything is in order, accepts them.

Certificate of Incorporation: Upon acceptance, Corporations Canada will return a Certificate of Incorporation and an Information Sheet to your email. This certificate confirms that your corporation has been officially formed.

Default Government Text: Share Transfer Restrictions

Your Articles of Incorporation may include provisions restricting the transfer of shares. The default text provided by the government typically specifies that no shareholder can transfer shares without the approval of either the directors or the majority of shareholders.

Default Government Text: Other Provisions

These can cover a variety of topics, but one common provision relates to the transfer of securities. By default, the corporation's securities, excluding non-convertible debt securities, cannot be transferred without the approval of the majority of directors, shareholders, or as stipulated in security holders' agreements.

Conclusion

In conclusion, Articles of Incorporation are a fundamental part of the process of establishing a corporation in Canada. They ensure that your business is legally recognized, with clear rules and guidelines for its operation. When creating your Articles of Incorporation, it's advisable to seek legal advice or use professional incorporation services to ensure compliance with Canadian regulations and to tailor the document to your business's specific needs. This critical step is essential for the success and legality of your new business venture in Canada.

Ribbon Makes Business Easy

To keep a corporation compliant is challenging. Ribbon gives entrepreneurs the tools to help them stay compliant. From setting up minute books, maintaining registers to annual filings, Ribbon let's Entrepreneurs focus on their business. Learn more about Ribbon or email support@getribbon.ai.

Appendix 1 - Sample Articles of Incorporation