Officers and Directors

Overview

Corporations in Canada have three distinct roles; officers, directors and shareholders. Officers run the day to day operations of the corporation. Directors are responsible for supervising the activities of the corporation and for making decisions regarding those activities. Shareholders own part or all of the corporation.

It is permitted for the same individual to be an officer, director and shareholder of a corporation simultaneously and this is common in smaller companies.

Officers

Officers are responsible for the day to day operations of a corporation. Officers are appointed by the board of directors. Officer positions can be any name but are typically President, Treasurer, Secretary, etc. Officers can be shareholders or directors of the corporation, or both, but they do not have to be. One person could act as a director, officer and shareholder simultaneously. For many small businesses, one individual is the sole director, the sole officer and the sole shareholder.

Directors

Directors are responsible for supervising the activities of the corporation and for making decisions regarding those activities.

Board of Directors

The Board of Directors must comprise of a minimum of one director, specifics on the number of directors can be found in a corporation's articles of incorporation.

The board is responsible for activities such as:

- Appointing Officers

- Approving Financial Statements

- Issuing Shares

- Issuing dividends

- Calling Board of Directors Meetings

- Calling Shareholders Meetings

- Make, amend or repeal bylaws (for shareholder approval)

- Make banking arrangements

Director Requirements

The Canada Business Corporations Act Outlines clearly the requirement for each director:

Qualifications of directors

105 (1) The following persons are disqualified from being a director of a corporation:

(a) anyone who is less than eighteen years of age;

(b) anyone who is incapable;

(c) a person who is not an individual; or

(d) a person who has the status of bankrupt.

Canada Business Corporations Act

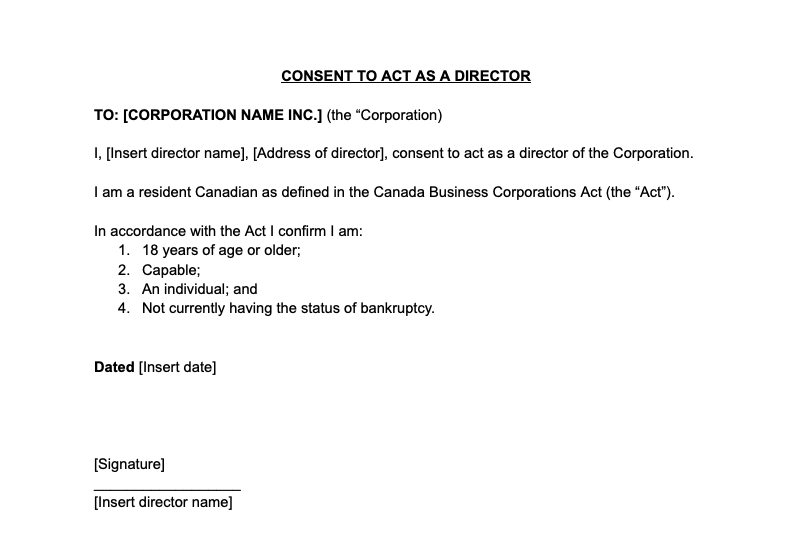

Typically directors will sign a document consenting to act as a director for the corporation and acknowledging they meet the requirements.

Example Consent to Act as a Director

Meetings & Resolutions

Board of Directors meetings can be held whenever and wherever the Board wishes. This flexibility can be limited by the Bylaws and Articles of Incorporation. Conduct of the meetings are typically set in the Bylaws.

A written resolution can be issued in place of the meeting but must be signed by all directors. Written resolutions are often easier for smaller corporations, conducting straight forward business with a limited number of directors.

Officer and Director Liabilities

Because the scope of authority of the corporation's management (the directors and officers) is so broad, the law imposes a wide range of duties and liabilities on them. In general, these duties and liabilities reflect the position of trust that directors and officers hold in relation to the corporation and its owners, the shareholders. While many of the duties and liabilities of directors and officers are prescribed under the Canada Business Corporations Act, other duties and liabilities:

- are set out in other federal, and provincial or territorial statutes or

- result from court decisions.

Duty of Care

The Canada Business Corporations Act outlines that Officers and Directors must act in the best interest of the corporation.

Duty of care of directors and officers

122 (1) Every director and officer of a corporation in exercising their powers and discharging their duties shall

(a) act honestly and in good faith with a view to the best interests of the corporation; and

(b) exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

Canada Business Corporations Act

Specific Liabilities

Directors and officers should also be aware of the specific requirement to pay employee wages and taxes.

Specific liabilities

The [Canada Business Corporations Act] also imposes certain specific liabilities on directors and officers of a corporation. In certain circumstances, directors are liable for up to six months' worth of unpaid wages to employees of the corporation, as well as for any unpaid source deductions.